01

Nov 2016

Spain continues to recover

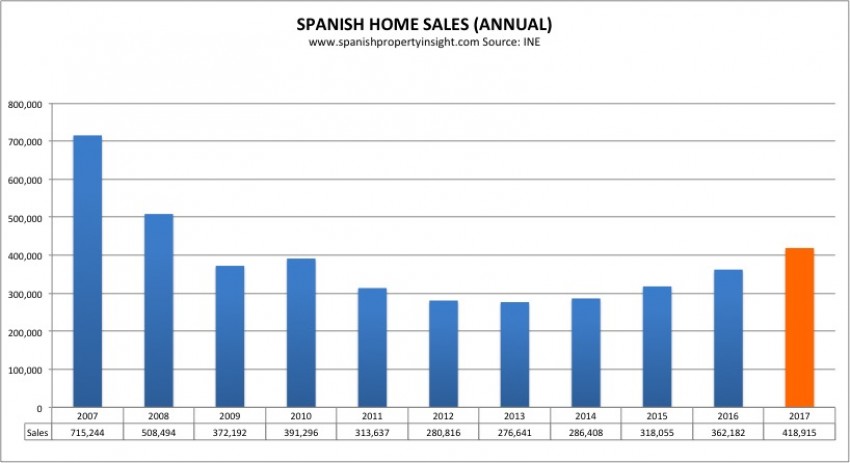

BBVA Research, the analytical arm of the Spain-based global bank, is forecasting a 6.5% increase in property transactions across Spain in 2017, allied to average price increases of more than 3.5%.

This positive outlook comes at a time of relative uncertainty in Spain, not least the ongoing issue of just who will be governing the country come 2017, and the as-yet-unresolved Brexit conundrum…

According to the bank’s estimations, around 475,000 home transactions will be recorded next year as domestic demand continues to solidify and foreign demand also increases, diversifying as more Chinese, American and Scandinavian buyers move in.

And as confidence continues to build, so too, do actual homes: the analysts expect that around 70,000 new building licences will be issued in 2017, rising 40% on the number issued last year.A 3.5% increase in property prices would bring the average Spanish home back to 2004 values.

This means that pre-boom prices will be the norm once more, with very few analysts expecting a similar explosion of growth that followed in 2005 as credit-fuelled consumers inflated the market.

This time, growth will be more sober as interest rates remain low and keep economic expansion within manageable levels. Indeed, BBVA expects some 800,000 new jobs to be created in Spain next year, which – if accurate – will be just the tonic Spain needs to continue on its recuperative course.